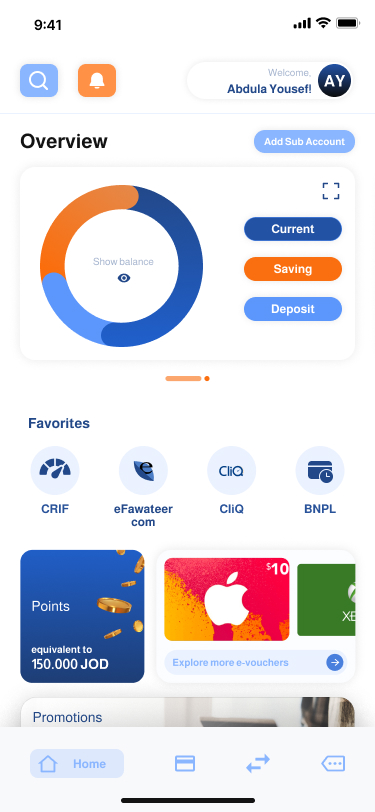

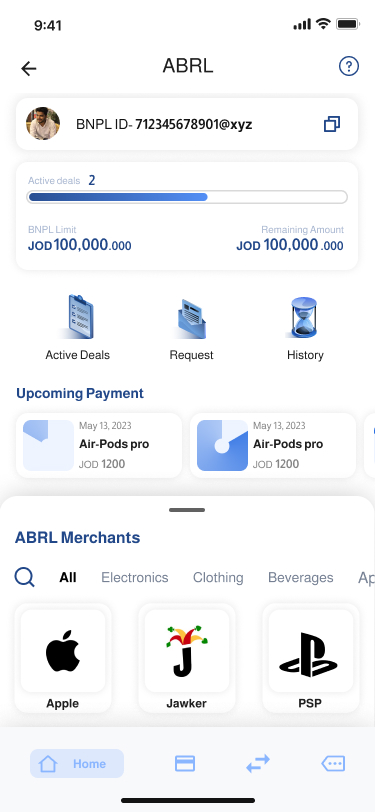

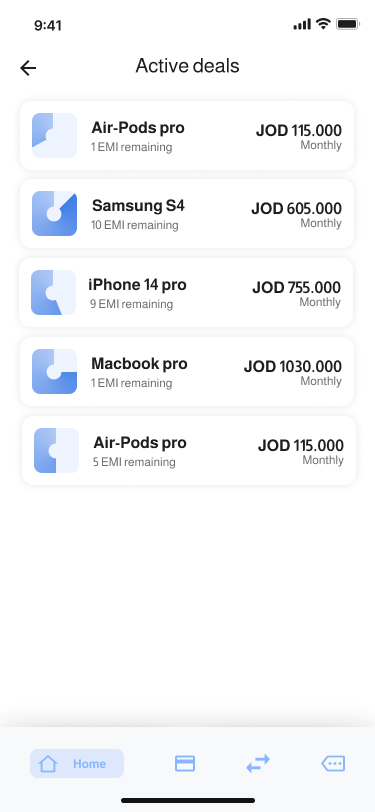

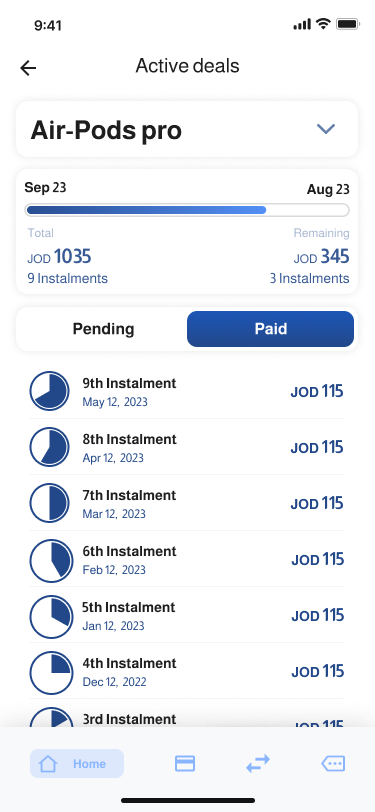

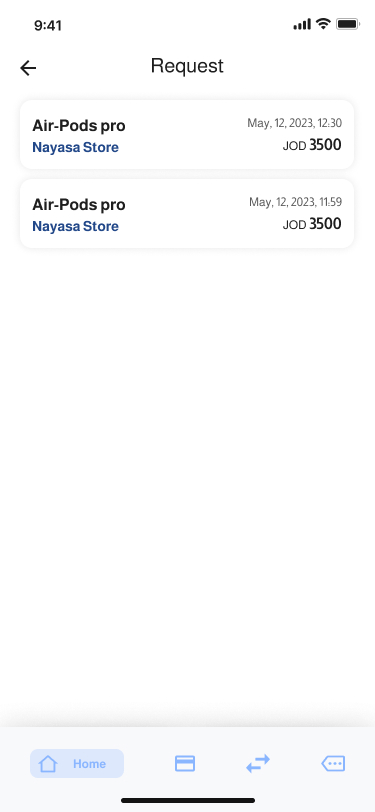

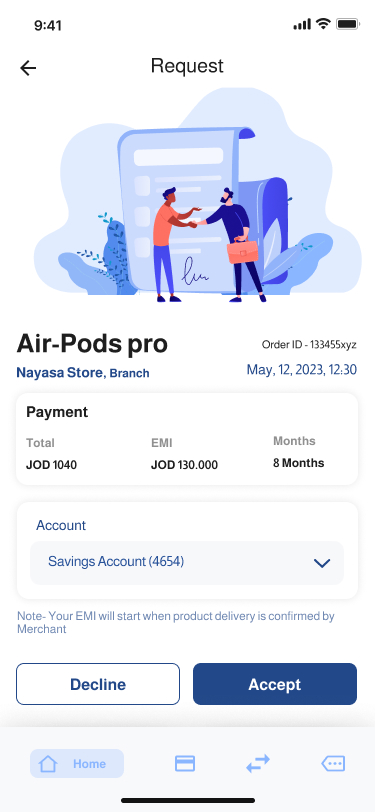

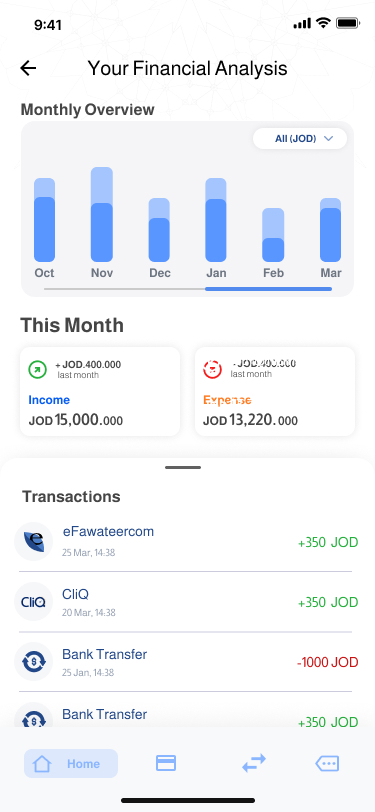

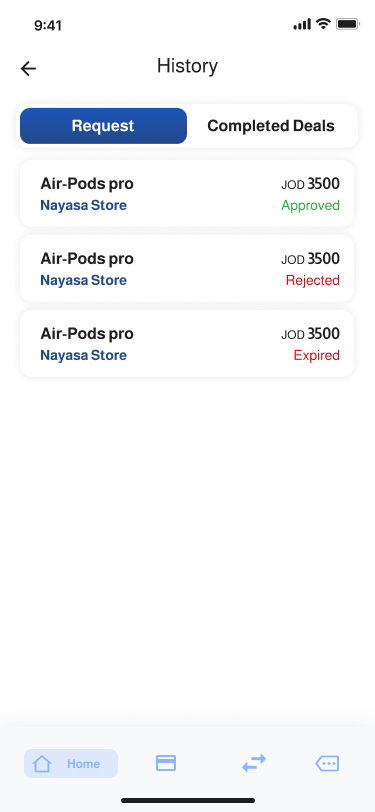

A leading bank in the Middle East aimed to launch an application tailored for migrants, students, and middle-income groups who find it difficult to purchase electronic items with a lump-sum payment. Their goal was to provide a user-friendly app that allows customers to easily track their EMIs and access special offers.

Migrants, students, and middle-income earners often struggle to afford devices with

one-time payments. Lack of flexible payment options and EMI tracking tools adds to

financial stress.

Offers are missed, payments get delayed, and users are left with no clear visibility

into their dues or benefits. A simple, centralized solution is missing—one that empowers

users to track, manage, and plan their purchases with ease.

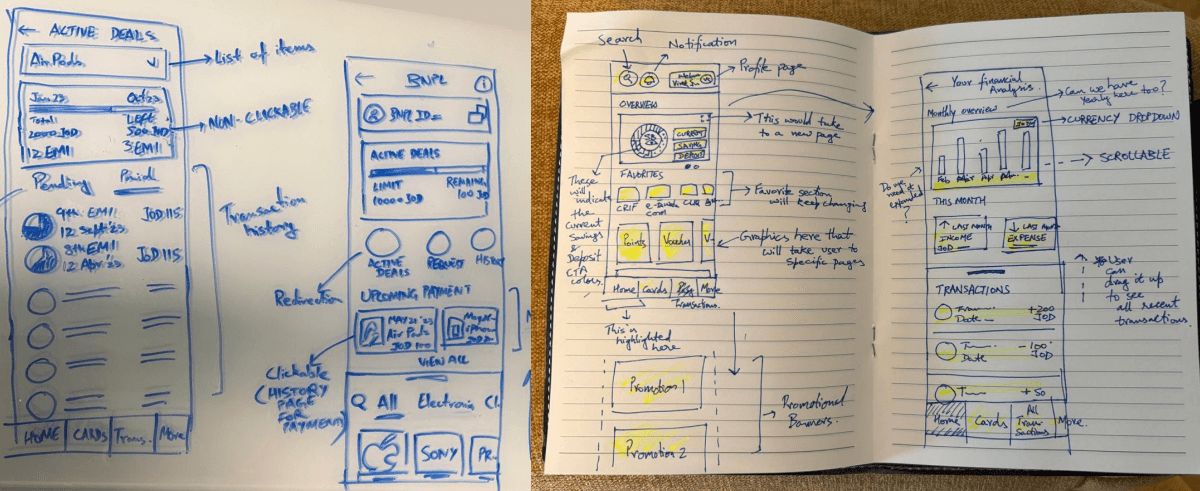

We conducted user interviews and surveys to understand financial struggles, identify pain points in big-ticket purchases, and design a solution that enables hassle-free EMI management with personalized offers.